- 63% of advisers report increasing client nerves about volatility

- 54% report growing concerns about investment risk

Almost three quarters (72%) of financial advisers have left their clients’ asset allocations the same throughout the volatility caused by Covid-19. Research from Canada Life Asset Management today reveals this hands-off approach taken by advisers, with only 14% taking steps to reduce their clients’ exposure to riskier assets, such as emerging market equity or high-yield bonds.

This long-term view is mirrored by their clients’ investment goals which have also largely stayed the same, according to the research. However, client trepidation is growing with 63% of advisers saying their clients have become more fearful of volatility since the start of the year and more than half (54%) reporting increasing concern about investment risk.

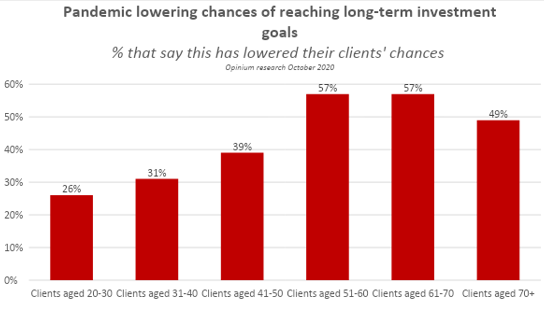

Advisers are also becoming increasingly concerned about the chances of reaching their clients’ investment goals – particularly those clients over 50 years old as they get closer to retirement.

Craig Metcalf, Head of Strategic Alliances at Canada Life Asset Management, said:

“Advisers have long memories and are adept at keeping their cool, adopting a longer-term view as they have likely navigated clients through previous market turmoil, including 2008 and the dot.com bubble.

“However, for some of their clients the pandemic has spooked them and many say they are feeling apprehensive or concerned about the safety of their investments and their likelihood of reaching their goals. As we navigate the next few weeks and look towards 2021, advisers will be making decisions to ensure their clients’ risk of exposure to markets, both upside and downside, is factored in. By adopting diverse, multi-asset strategies advisers will be positioning their clients well for future volatility.”

ENDS

Enquiries:

Press enquiries should be directed to:

Sophie Paterson at Vested, 07540 496 159, canadalife@fullyvested.com

Rebecca Smith at Canada Life, 07435 924 479, Rebecca.Smith@canadalife.co.uk

Notes to editors:

- Opinium research of 200 independent financial advisers between 20th - 26th October

Notes to Editors:

About Canada Life Asset Management

At Canada Life Asset Management, we manage £40bn* in fixed income, equities, UK property and multi-asset solutions. Our range of investment solutions has been designed to support financial advisers and their clients in meeting their long-term objectives.

Each of our offerings has been built for a purpose, whether it sits at the core of a portfolio to provide long-term growth or offers access to a specific global market. Our 40-year + history as asset managers gives us the expertise necessary to provide the highest quality multi-asset and risk-profiled solutions as well as attractive equity, fixed income and alternative funds, and real estate finance. For more information visit www.canadalifeassetmanagement.co.uk

As at 30/09/2020

The value of investments may fall as well as rise and investors may not get back the amount invested.

Canada Life Asset Management is the brand for investment management activities undertaken by Canada Life Asset Management Limited, Canada Life Limited and Canada Life European Real Estate Limited. Canada Life Asset Management Limited (no. 03846821), Canada Life Limited (no.00973271) and Canada Life European Real Estate Limited (no. 03846823) are all registered in England and the registered office for all three entities is Canada Life Place, Potters Bar, Hertfordshire EN6 5BA. Canada Life Asset Management Limited is authorised and regulated by the Financial Conduct Authority. Canada Life Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Please note that while Canada Life Asset Management and Canada Life Limited are regulated as stated above, property management and the provision of commercial mortgages are not regulated activities.