By Andrew Morris, Senior Product Specialist, Canada Life Asset Management

A single decumulation strategy often falls short of addressing the myriad risks that can erode retirement savings over time. We explore different strategies that can be considered when defining a retirement plan, with varying levels of flexibility, complexity and certainty of income.

The sustainable withdrawal rate

One of the best-known decumulation approaches, sustainable withdrawal strategies see investors withdrawing a set amount per year, whether as an absolute value or a specific percentage.

Taking a fixed amount from the pot during the first year, subsequently adjusted for inflation, is straightforward to understand – however, the fixed withdrawal leaves the portfolio vulnerable to pound cost ravaging (see 'The main decumulation risks' below). It also does not capture extra growth in good years, meaning investors might 'miss out' on additional income when markets perform well. A modification of this approach, the constant percentage approach (withdrawal of a fixed percentage of a portfolio’s current value each year), is where, unlike constant dollar, the withdrawal amount fluctuates with market performance. However, this market sensitivity can prove a disadvantage as the annual income can become volatile.

A third approach, floor and ceiling, in many ways offers the best of both worlds. Combining elements of both fixed and variable withdrawals, an agreed minimum and maximum withdrawal amount is set with the client. The withdrawal is calculated yearly (often using a constant percentage approach) but capped to never fall below the floor or rise above the ceiling. It therefore offers a level of predictability similar to the constant 'dollar' approach, but also the greater flexibility of the constant percentage amount. The extra complexity makes it slightly more challenging to manage as care must be taken to determine appropriate floor and ceiling values.

The cash buffer

Keeping a portion of your retirement portfolio equal to several years’ worth of living expenses in liquid, cash-like instruments (such as high-yield savings accounts, money market funds, or short-term bond funds) is known as the cash buffer approach. The majority of the assets are invested in higher-growth assets such as equities, bonds or diversified funds, to provide long-term growth. This approach aims to provide immediate liquidity to cover income needs, allowing the bulk of the portfolio to grow over time while mitigating immediate pound cost ravaging.

Find out about the process and see a more detailed summary of advantages and disadvantages.

This approach allows investors to protect themselves against adverse market conditions and reduce the risk of decumulation while providing certainty of income over the period. However, it requires care to ensure that not too much of the portfolio is held in low-yield cash, while still preserving a sufficient buffer to avoid forced sales during market dips. Regular rebalancing and monitoring are key to maintaining the strategy over the long term. Find out more.

Natural income

This approach uses funds that are designed to generate a steady stream of income directly from their underlying assets – such as interest from bonds, dividends from equities, and rental income from real estate. They distribute that income on a regular (often monthly) basis without the need to sell assets to generate cash, mitigating pound cost ravaging. They often have a mix of assets, meaning that income isn’t solely dependent on one type of asset.

For this approach, a key advantage is the stable cash flow that is generated naturally from the fund’s holdings. This reduces the need to sell investments during market downturns, which also means that the portfolio’s principal can be preserved for longer. Predictable monthly payments can simplify budgeting and help with planning living expenses.

However, a portfolio designed primarily for income may sacrifice some capital appreciation. This might be a disadvantage for clients who need both income and growth to combat inflation over a long retirement. And, because income levels depend on the performance of the underlying assets, in low-yield environments, monthly distributions might not be sufficient to cover all expenses.

Annuity, income and growth

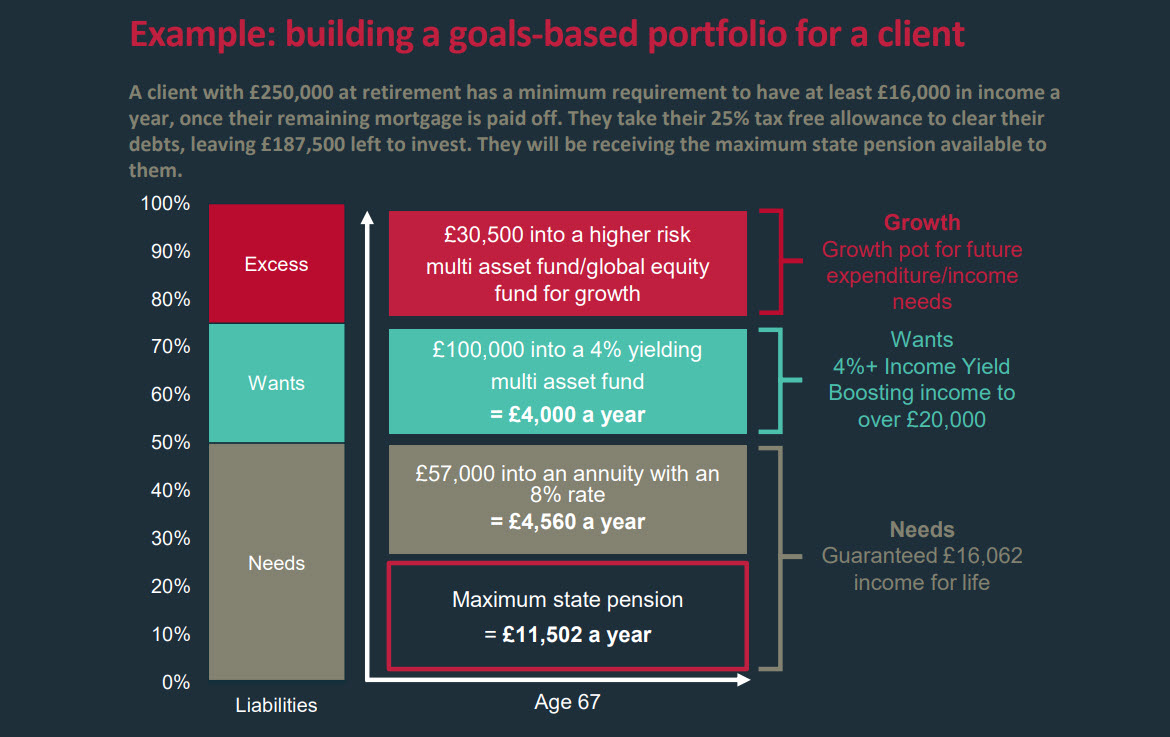

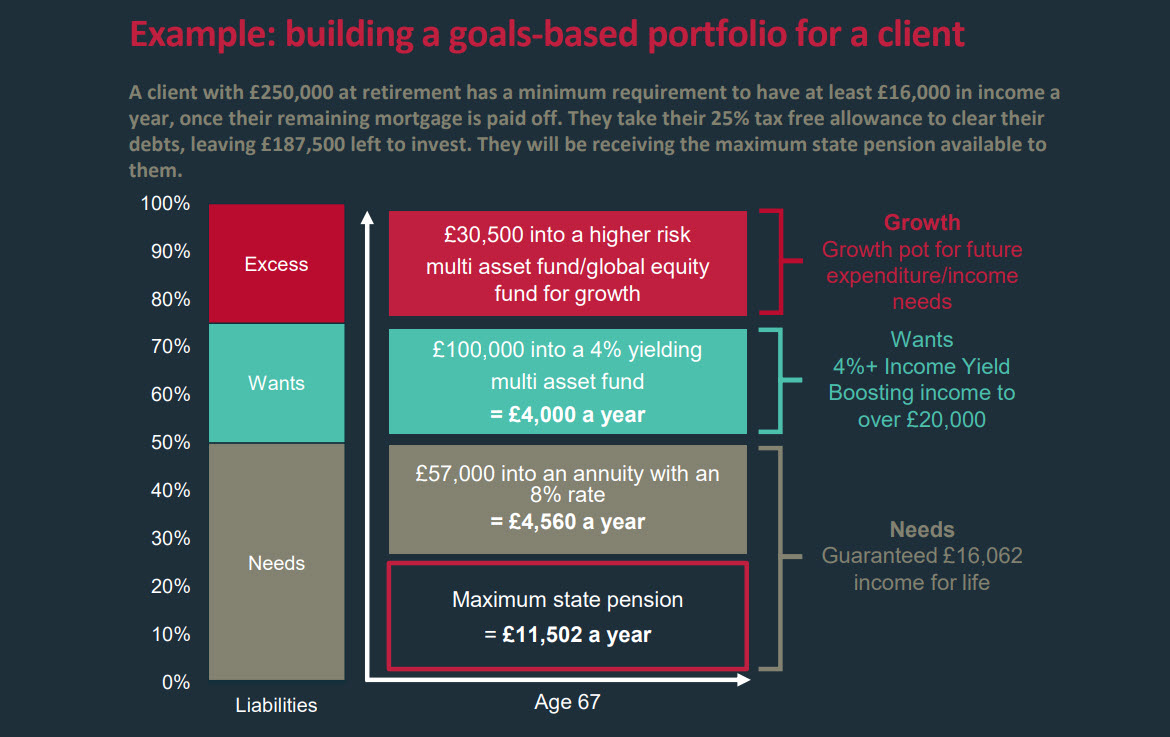

Blending an annuity with other investments to create an income/growth portfolio can offer the best of both worlds, especially for those clients needing some certainty of income but also some flexibility. Here, the annuity offers income security, mitigating the risk of running out of money for basic needs. Meanwhile, the natural income fund supplies regular income for discretionary spending, and the growth fund aims to generate capital appreciation, as well as being a secondary source of income/capital if needed.

By splitting the portfolio into different components, the strategy reduces sequencing risk (see 'The main decumulation risks' below). The annuity shields the client from market downturns, and the natural income fund minimises forced selling during volatile periods. The strategy also mitigates longevity risk (see below) as the annuity provides an income for life.

The blended approach requires careful coordination between the three components, which may involve more active management and regular reviews. Also, annuities can have high fees, while the expertise involved in active management of funds can increase overall costs.

Here is an example of such a portfolio:

Pot investing

Finally, pot investing, or a ‘bucket‐style’ approach, uses a multi‐fund strategy where each fund has a distinct risk profile. The idea is to split the retirement portfolio into three equal parts – low, moderate and higher risk (around risk profiles 3, 5 and 7 respectively), averaging to a moderate level (risk profile 5). Income is taken exclusively from the low‐risk fund, while the moderate and higher-risk funds are left to grow. At the end of each year, the portfolio is rebalanced back to the original allocations, which replenishes the low‐risk 'income bucket’.

This approach offers a more sustainable income stream: by always withdrawing from the low-risk bucket, the strategy helps to protect the income stream from market volatility; meanwhile the moderate and high-risk funds are left to grow. This structure helps minimise sequencing risk since the income bucket is less exposed to market swings, and the regular rebalancing process helps avoid depleting the portfolio too quickly.

This strategy requires diligent, ongoing monitoring and periodic rebalancing; frequent rebalancing may incur higher transaction costs, which can eat into returns.