Gold appears to have acquired magnetic qualities in recent months, attracting investors and speculators alike. At Canada Life Asset Management we are most definitely prudent long-term investors, not speculators. We do, however, have small exposures to gold production to help manage risk in some of our multi-asset portfolios.

In early August 2020 the gold spot price rose above US$2,000 per ounce for the first time ever, before slipping back to nearer US$1,900. This eclipses the highs gold achieved in 2011 when, in the wake of the 2008 Global Financial Crisis, fears of inflation and currency devaluation fuelled by unprecedented levels of government debt sent gold to slightly over US$1,800 per ounce.

Behind these new price highs lie the same fears as in 2008 – of inflation, collapsing equity markets and devaluation of currencies as a result of vast levels of debt. Gold prices at these levels naturally raise the question of whether they could possibly rise any further, and whether gold still has a role to play as a dependable portfolio diversifier.

The uses of gold

Gold can be socially divisive. Its detractors argue that gold does not produce a yield and therefore cannot be valued in terms of its future cash flows; that it actually costs money to store physical gold; and that its price can be highly volatile. Meanwhile, ardent supporters of the yellow metal argue that gold is a store of value that will outlive currencies and fend off rampant inflation.

Our own view is more nuanced, acknowledging the downsides of gold but seeing practical uses for it as a tool to mitigate several tail risks to our portfolios.

We currently have small exposures to gold in the LF Canlife Balanced, LF Canlife Managed 20-60 and Diversified Monthly Income funds in the form of shares of individual mining companies such as Centamin, and ETFs that provide diversified exposure to gold producers.

At times, gold producers’ shares can be more volatile than physical gold, but they offer several advantages. Unlike physical gold, which entails storage costs, gold mining companies produce earnings and may pay dividends, generating income for our multi-asset portfolios and enabling us to assess the valuations of mining companies. Furthermore, mining companies shares can rally strongly when demand for gold is rising, thus providing effectively geared exposure to gold.

If equity markets fall again as a result of a resurgence in COVID-19 cases or roadblocks on the way to economic recovery, such as delays in developing or deploying vaccines, gold is likely to benefit as investors seek safe havens.

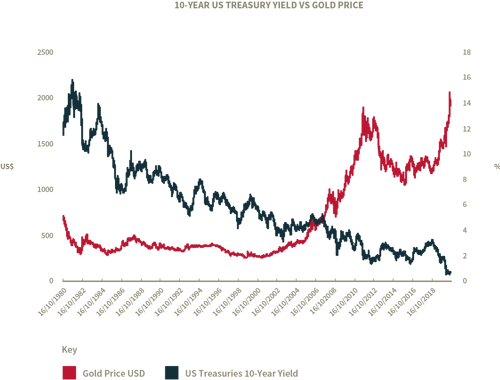

Secondly, as chart 1 below shows, the rise in the gold price is closely aligned to declining government bond yields, which are now at extremely low levels. Part of the rise in the gold price is attributable to some investors now preferring gold over sovereign bonds, which offer little, no, or even negative yields. This trend is likely to grow if more central banks introduce negative interest rates.

Source: Bloomberg, data for 16/10/1980-16/09/2020

Do you remember inflation?

Gold is widely used as a traditional hedge against inflation and recessions. Research from Unigestion indicates that that it averaged annual returns of 10% during inflationary periods and matched bond returns during recessionary periods between 1974 and 2017.[1]

In the current economic environment, most governments and central banks would welcome a rise in inflation as evidence that their ultra-low monetary policies and vast economic stimulus packages are having the desired effect.

A rise in inflation would also begin to erode the value of the mountain of government debt which has piled up. In just three months the Federal Reserve’s (Fed’s) balance sheet expanded by US$3tn. By contrast, it took six years for the Fed to accumulate this level of debt following the 2008 financial crisis.

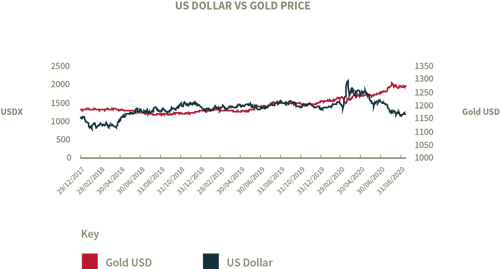

For many governments, reducing the value of government debt through inflation is perhaps the most politically palatable alternative to raising taxes or imposing austerity programmes. However, a side-effect of inflation would be the erosion of the value of their currencies. As chart 2 shows, the gold price tends to strengthen as the US dollar weakens.

We do not see compelling arguments for inflation taking off significantly for the foreseeable future. The vast levels of government debt accumulated since 2008 have not sparked a wave of inflation, and we see few indications that the increase in this debt resulting from COVID-19 will do so. As we move into a post-COVID economic recovery, demand will rise but from a low base. With so much spare capacity in the world economy, prices are unlikely to rise significantly. The Office for National Statistics’ most recent 12-month Consumer Prices Index inflation rate was 0.6%, well below the Bank of England’s 2% target.[2]

We do, however, see long-term trends in the form automation and digitisation that will continue to exert powerful long-term deflationary forces, despite current geopolitical tensions and trade disagreements between the US and China. That said, statements from Jerome Powell, Chairman of the Federal Reserve (Fed), in December 2019 and again in August this year, indicate that the Fed is willing to let inflation rise moderately above its target of 2%.[3] In particular, Chairman’s Powell’s statement on 27Th August 2020 describes the Fed’s more relaxed attitude to inflation as “robust updating” of its policy. Having some exposure to gold helps to counter this inflationary risk.

We fully expect there to be volatility in the gold price over the coming months as economic data reveals the likely course that recovery will take, and speculative money enters and exits gold markets. We will however, be looking for opportunities to add marginally to our gold exposures as opportunities arise. Like all insurance, gold becomes particularly expensive when you really need it.

Source: Bloomberg, data at 16/09/2020. The Bloomberg Dollar Spot Index (USDX) tracks the performance of a basket of ten leading global currencies versus the US dollar.

[1] Source: Unigestion, Perspectives, Gold in a normalisation phase, August 2018

https://www.unigestion.com/wp-content/uploads/2019/01/Gold-in-a-policy-normalisation-phase.pdf

[2] Source: Office for National Statistics, June Release, 15th July 2020.

[3] https://www.cnbc.com/2019/12/11/fed-chair-powell-says-he-would-want-to-see-persistent-rise-in-inflation-before-hiking-rates-again.html; https://www.cnbc.com/2020/08/27/jerome-powell-fed-speech-live-updates.html#:~:text=In%20a%20move%20that%20Chairman,has%20run%20below%20that%20objective.

The information contained in this document is provided for use by investment professionals and is not for onward distribution to, or to be relied upon by, retail investors. No guarantee, warranty or representation (express or implied) is given as to the document’s accuracy or completeness. The views expressed in this document are those of the fund manager at the time of publication and should not be taken as advice, a forecast or a recommendation to buy or sell securities. These views are subject to change at any time without notice. This document is issued for information only by Canada Life Asset Management. This document does not constitute a direct offer to anyone, or a solicitation by anyone, to subscribe for shares or buy units in fund(s). Subscription for shares and buying units in the fund(s) must only be made on the basis of the latest Prospectus and the Key Investor Information Document (KIID) available at www.canadalifeassetmanagement.co.uk.

The LF Canlife multi-asset funds may invest in property funds that may be illiquid and subject to wide price spreads, both of which can impact the value of the funds. The value of the property is based on the opinion of a valuer and is therefore subjective.

Canada Life Asset Management is the brand for investment management activities undertaken by Canada Life Asset Management Limited, Canada Life Limited and Canada Life European Real Estate Limited. Canada Life Asset Management Limited (no. 03846821), Canada Life Limited (no.00973271) and Canada Life European Real Estate Limited (no. 03846823) are all registered in England and the registered office for all three entities is Canada Life Place, Potters Bar, Hertfordshire EN6 5BA. Canada Life Asset Management Limited is authorised and regulated by the Financial Conduct Authority. Canada Life Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

CLI01712 Expiry 31/03/2021